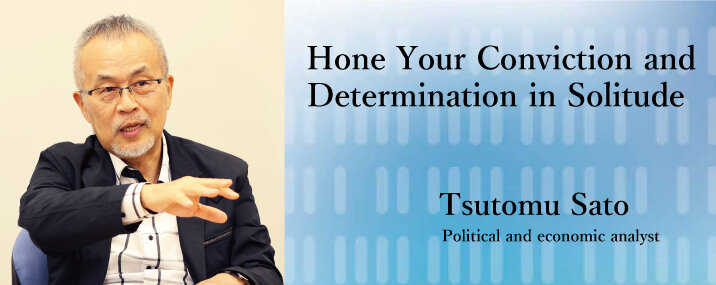

Vol.26 Interview with Donors

Tsutomu Sato

Born in Mie Prefecture in 1955. Graduated from the Department of Metal Science and Technology, Faculty of Engineering, Kyoto University, in 1979. After working at Wako Securities (now Mizuho Securities), joined Goldman Sachs in 1988 as a chief bond trader. Became a partner of the US headquarters in 1998 in recognition of his contribution to profits in the bond division. Served as the Tokyo Branch Manager and left the company in 2003 at the age of 47. Been active as a financial market analyst since then. Been involved in market analysis of Japanese and U.S. interest rates, stocks, and exchange rates, and has contributed articles to economic newspapers and given lectures.

Q Would you care to share with us your college memories?

I did not intend to stay in my hometown in Mie Prefecture, but I did not want to be a financial burden on my parents.With this in mind, universities in the Kanto region were not an option, and I chose Kyoto University, a leading university in western Japan. My first impression after entering the University was that the school was diverse. The fact that there are fewer local students than in the Kanto region and that students come from all over the country may have an effect on the culture of Kyoto University. I felt like my world had expanded at once.

My father died in October of my freshman year, and since I did not want to put any more burden on my mother, I took on all kinds of part-time jobs. I did not have time for club activities, and I moved my residence from a boarding house to a dormitory. By the way, there were people in the dormitory who were involved in student movements, and I accompanied them on a couple of demonstrations. I was an apolitical student, but looking back, it was a valuable experience.

Now that I have become a working member of society, there are times when I think I should have done something when I was a student, but to be honest, I am glad I spent my time lazily. There will never be a time in your life after college when you can live lazily. If you ask me, I sometimes wish I had studied English conversation more, but that is something I can brush up on at any time. Even if I feel like I have been wasting my time, the experience must be helping me in one way or another.

Q You graduated from the Faculty of Engineering. Why did you join a

securities company, which seems to be a completely different field

from engineering?

I had no intention of becoming an engineer. I chose the Faculty of Engineering simply because I was good at math and science, but I did not find my classes interesting, and with its segmented specialties, the Faculty of Engineering was not for me. I wanted to see a bigger world. I realized early on that becoming an engineer was not the future I was aiming for.

In the latter half of the 1970s, trading companies, banks, and life insurance companies were typical employment opportunities for liberal arts students, but the employment opportunities were limited to students in the Faculty of Economics and the Faculty of Law. Science majors were turned away at the door. I tried two or three companies, but just as I expected, they were not interested in me. When I was wondering what to do, I found a job opening at a securities firm on the job board of the Faculty of Engineering, so I attended an interview and immediately received a job offer. That was Wako Securities (now Mizuho Securities). That year, 130 people were hired, of which only two were science majors. This was the year they started hiring science majors because they needed science majors to build systems by analyzing the investment know-how of bonds and stocks. In other words, they were hiring by job type.

In my first year, I was assigned to the bond trading field, but in my second year, I do not know what they saw in me, but I was given the position of trader. Traders act as intermediaries in bond trading and are required to receive sell and buy orders and quickly determine the trading amount. Even back then, the minimum amount per transaction was one billion yen. At Goldman Sachs, where I worked after being headhunted, I sometimes received orders worth 200 billion yen. You need to be able to quickly assess profit and loss as a trader and make the decision to sell or buy. What you need is courage and market foresight. I think this is the most unsuitable job for Japanese people. I joined a securities company by chance, but I guess it matched my personality and talent.

I decided to retire at the age of 47 partly because I was no longer stimulated after being away from that field and also because I was proud of the fact that I had worked three times as hard as people in Japanese companies. I thought I had enough. Thereafter, I worked as a political and economic analyst.

The belief that I have built up during my career is that I am a solitary person. Being a trader was not a job that I could do by consulting with someone else, so I had to analyze markets and make decisions on my own. People only listen to the things they want to hear and see the things they want to see, but that narrows the world. I believe that my ability to make judgments and decisions came from my ability to always think about things with a wide range of interests and perspectives.

Q What kinds of efforts do you look forward to seeing Kyoto University

make in this 125th anniversary year and after, and is there a

message you want to leave Kyoto University students with?

One of the greatest strengths of Kyoto University is its diversity. It may be easy to foster diversity in terms of pure academics at Kyoto University because the school is not influenced by various connections with corporations. I would like Kyoto University to remain as it is, but if I were to ask for a favor, it would be to strengthen its ability to promote itself. I only recently came to know about the Kyoto University Fund and the University's 125th anniversary. Please make up for the geographical disadvantage with your ability to communicate and create appeal.

To students, I would like to say, "Don't hang around with others." In a company, you cannot grow big if you hang around with others. I look forward to seeing students hone their conviction and determination in a solitary environment.

(Interviewed in August 2021)